US Customs and Border Protection (CBP) enforces classification rules with unforgiving precision. In 2026, simply guessing your HS Code—or blindly using the code provided by your supplier—can trigger higher tariffs, shipment delays, or even customs seizures.

For example, declaring a smart watch as a digital watch can raise the duty rate from 0% to 10%. Misclassifying kitchen knives or candles may result in intensive exams or retroactive penalties months later.

Choosing the wrong HS Code is not a typo in the eyes of CBP—it can be treated as customs negligence or fraud. This guide explains the 2026 HS Code classification rules and shows Amazon sellers and importers how to identify the correct code while keeping duties legally as low as possible.

What Is an HS Code?

An HS Code (Harmonized System Code) is a 10�digit classification number used by US Customs to identify imported products and calculate duties.

How Many Digits Is a US HS Code?

- First 6 digits: International standard (the same in China, the US, and most countries)

- Last 4 digits: US�specific HTSUS code that determines your exact duty rate

HS Code vs HTS Code: What’s the Difference?

- HS Code: Global classification system

- HTS Code (HTSUS): The US implementation of the HS system

Using a Chinese export HS Code for US import clearance is one of the most common causes of customs delays and audits.

|

Feature

|

HS Code (Global)

|

HTSUS Code (USA)

|

|

Digits

|

6 Digits

|

10 Digits

|

|

Purpose

|

Universal Identity

|

Duty Rate Calculation

|

|

Who Sets It

|

WCO (Global Org)

|

US ITC (US Gov)

|

|

Risk

|

Low

|

High (Determines Taxes)

|

Who Is Responsible for HS Code Classification?

The US Importer of Record (IOR) is legally responsible for HS Code accuracy—not the factory, not the freight forwarder, and not Amazon. If you are using a DDP service, ensure your forwarder is filing with a legitimate bond.

How to Find the Right HS Code for Your Product

Correct classification starts with understanding your product—not guessing.

HS Code Search by Product Description

When searching for an HS Code, focus on:

- Product material

- Function and use

- Level of processing

- Technical features (electric, wireless, chemical composition, etc.)

Generic descriptions lead to incorrect codes.

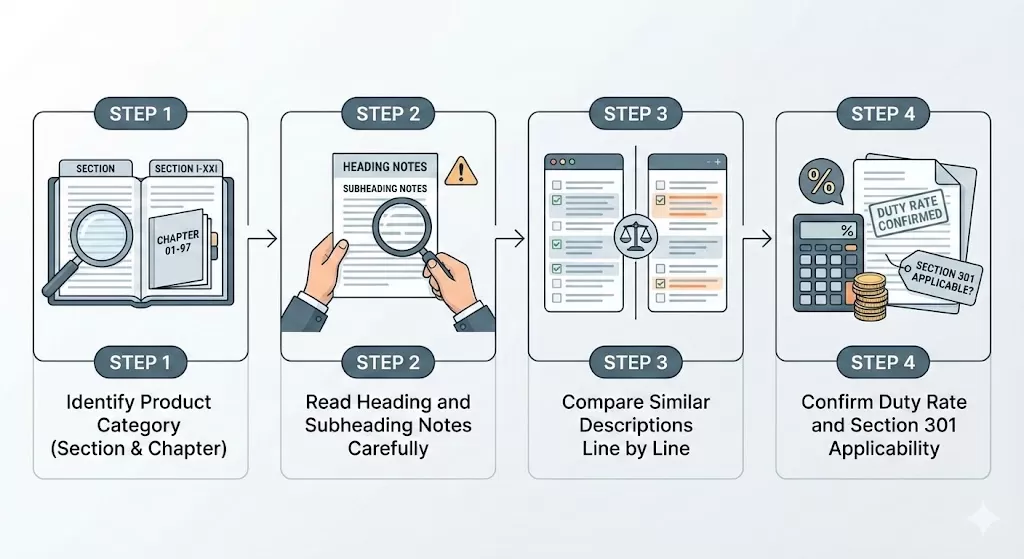

Using the HTSUS Database Step by Step

- Identify your product category (Section & Chapter)

- Read heading and subheading notes carefully

- Compare similar descriptions line by line

- Confirm duty rate and Section 301 applicability

The HTSUS database exceeds 4,000 pages—misreading one note can change your duty rate entirely.

Can You Use Your Supplier’s HS Code?

Short answer: No.

Chinese factories provide export HS Codes for China Customs. These often do not match US HTSUS classifications and should never be used without verification.

Never copy-paste the HS Code from your Alibaba supplier's invoice directly to your US Customs Entry. China uses the code to calculate Export Rebates; the US uses it to calculate Import Tax. They are rarely the same.

Wrong HS Code Penalties in the United States

HS Code mistakes directly impact your costs and compliance record.

Overpaying Import Duty (The Lazy Tax)

- Product: Bluetooth Headphones

- ❌Wrong Code: Generic audio equipment (5% duty)

- ✅Correct Code: Wireless headphones (0% duty)

Result: You voluntarily overpay import taxes on every shipment. This invisible cost inflates your total Amazon FBA shipping costs and eats into your profit margins without you even knowing.

Underpayment & Customs Audits

- Product: Wax candles

- Mistake: Using a generic home décor code to avoid anti�dumping duty

- CBP Action: Post�entry audit 6 months later

- Penalty: 108% anti�dumping duty + monetary fines

Anti�Dumping & Section 301 Risks

Even if your base duty rate is 0%, Section 301 China tariffs may still apply depending on the HS Code.

2026 HS Code Classification Rules (GRI Explained)

Customs classification follows the General Rules of Interpretation (GRI).

Rule 1: Essential Character

If a product set contains multiple items, classify it based on the component that gives it its essential character.

Rule 2: Unassembled Goods

Unassembled or knocked�down products are classified as complete items.

Rule 3: Specificity Wins

Always choose the most specific description available.

✅ Electric toothbrush

❌Personal hygiene appliance

HS Code Classification for Amazon FBA Sellers

Amazon does not assign HS Codes. Sellers must ensure accuracy before shipment.

HS Code on Commercial Invoices

Your HS Code must match:

- Product description

- Declared value

- Country of origin

Inconsistencies are automatically flagged by CBP systems.

HS Code & Amazon FBA Customs Clearance

Incorrect classification can cause:

- FBA shipment delays

- Inventory stockouts

- Unexpected duty invoices

Professional HS Code Classification Support

Most freight forwarders require you to provide HS Codes to avoid liability.

Forest Leopard operates differently.

- Pre�Shipment Audit: Product review and invoice verification

- Duty Optimization: Legal classification strategies and exclusions

- Customs Defense: Supporting rulings if CBP challenges the code

Summary: Compliance Is Your Best Defense

Customs algorithms in 2026 automatically compare HS Codes against product descriptions and historical data.

HS Code Compliance Checklist

- Convert factory HS Codes to US HTSUS codes

- Check Section 301 and anti�dumping duties

- Never guess—verify before shipping

Stop overpaying duties or risking seizures. Send us your product details and receive a correct HS Code and the lowest legal duty rate.

Get My Free HS Code Classification

EN

EN

FR

FR

ES

ES

JA

JA

PT

PT

RU

RU

AR

AR