Brexit tariff changes + EU-wide EPR regulations + multi-country VAT compliance—by 2025, European FBA logistics costs have surged by 35%. Choosing the wrong freight forwarder could wipe out your profits overnight.

Key Data Points:

The European FBA market is projected to reach €420 billion by 2025, reflecting massive growth—and equally massive complexity.

Real-world consequences: A recent case saw a seller lose $50,000 due to customs clearance delays at Hamburg port, turning a profitable shipment into a total loss.

Article Value Preview:

This guide cuts through the noise and delivers what you actually need:

✅ 2025’s Top European Freight Forwarder Comparison Table – Based on verified data across 7 key metrics including pricing, transit time, and hidden fee structures.

✅ Transparent Cost Breakdowns for Sea, Rail, and Air Shipping – No vague estimates; real numbers for LCL, FCL, and express options from China/EU to major Amazon warehouses.

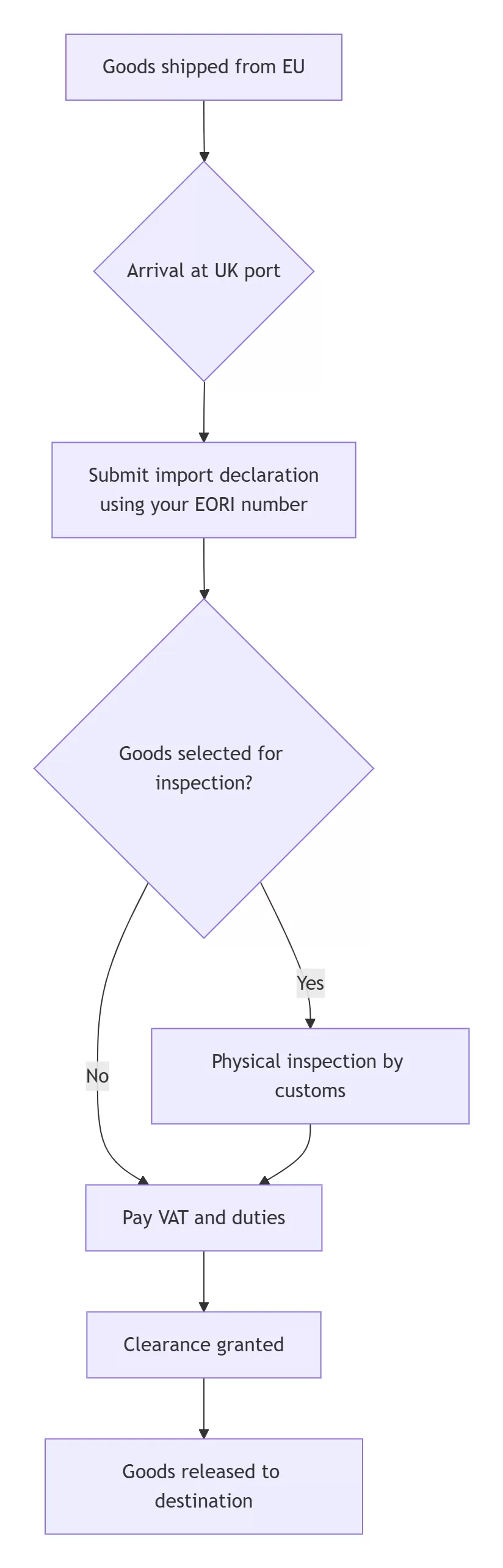

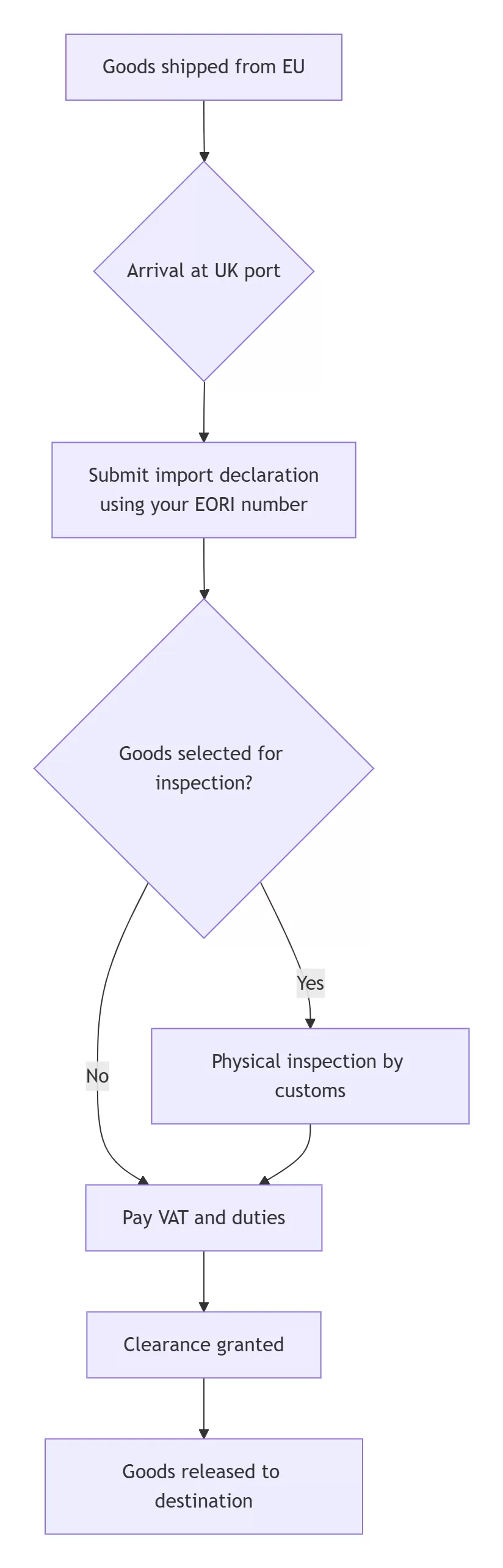

✅ Brexit Customs Clearance Flowchart – A step-by-step visual guide to navigating post-Brexit paperwork, taxes, and inspections—including red-flag avoidance tips.

Why This Matters Now:

The European FBA landscape is shifting faster than ever. New EPR laws require full packaging recycling registration in Germany, France, and Italy. Brexit has added layers of paperwork and cost for UK-bound shipments. Without a freight partner who truly understands these nuances, you risk delays, fines, and even account suspension.

This guide isn’t just another list—it’s a strategic toolkit built for Amazon sellers scaling in Europe’s high-stakes environment. We’ve compiled real data, vetted forwarders specializing in FBA workflows, and mapped out the exact steps to keep your goods moving smoothly and profitably.

Let’s dive in.

2. 5 Must-Have Capabilities for European FBA Freight Forwarders

|

Capability

|

Criticality

|

Europe-Specific Requirements

|

|

Multi-Country VAT Handling

|

★★★★★

|

Must support VAT deferral & filing

|

|

EU EPR Compliance

|

★★★★☆

|

Germany/France registration validation

|

|

UK Customs Expertise

|

★★★★

|

Post-Brexit BCP process knowledge

|

|

Pan-European Warehouse Network

|

★★★★

|

Must cover DE/FR/NL/IT hubs

|

|

24/7 Emergency Response

|

★★★☆

|

Multilingual crisis support

|

3. 2025's Top 7 European FBA Freight Forwarders

|

Service Provider

|

Key Markets

|

EU Warehouses

|

Sea Shipping €/m³

|

UK Clearance Time

|

Rating

|

|

Boss Continental

|

Germany/Poland

|

8

|

€110

|

48 hours

|

★★★★☆

|

|

Unicargo EU

|

UK/Netherlands

|

5

|

€130

|

72 hours

|

★★★★

|

|

Flexport Europe

|

France/Spain

|

12

|

€145

|

60 hours

|

★★★★

|

|

EuroCargo Chain

|

Italy/Belgium

|

6

|

€95

|

36 hours

|

★★★☆

|

|

Shapiro EU

|

EU-Wide

|

15+

|

€160

|

48 hours

|

★★★★☆

|

|

AMZ Freight Pro

|

Germany/Czechia

|

7

|

€125

|

24 hours

|

★★★★

|

|

Local Specialist: LogistEU

|

Eastern Europe

|

4

|

€85

|

N/A

|

★★★☆

|

Note: Pricing based on Shenzhen→Rotterdam LCL shipments (includes basic duties)

4. Europe FBA Shipping Costs & Timelines

4.1 Shipping Method Comparison

|

Method

|

Shenzhen→Germany

|

Avg. Cost

|

Best For

|

|

Air Freight

|

5-7 days

|

€6.5/kg

|

Urgent restocks <500kg

|

|

Sea Shipping

|

28-35 days

|

€120/m³

|

Cost-sensitive bulk shipments

|

|

China-Europe Rail

|

18-22 days

|

€150/m³

|

Balanced speed & budget

|

|

Trucking

|

14-16 days

|

€180/m³

|

Avoiding port congestion

|

4.2 Hidden Cost Alerts

UK Surcharges: Brexit clearance fee (€30/shipment) + border inspection (€15/hour)

EPR Fees: France packaging tax (€0.2/unit) + Germany WEEE registration (€250/year)

Peak Season: Q4 port congestion fee (+30% base freight cost)

Key Takeaways:

Local players like LogistEU dominate Eastern Europe routes at €85/m³

EuroCargo Chain delivers fastest UK clearance (36hrs) but limited EPR support

Trucking beats sea shipping during holiday port delays despite higher cost

Always budget for France's per-unit packaging tax - it adds up fast

5. Europe Customs Clearance Pitfall Guide (With Flowchart)

5.1 Post-Brexit UK Customs Clearance Process

Here’s a simplified breakdown of the UK customs process after Brexit — perfect for beginners:

Key Pitfalls to Avoid:

🚫 Using CE Marking Instead of UKCA

Since 2025, the UK no longer recognizes the EU’s CE mark. You must use the UKCA mark for goods sold in Great Britain (England, Scotland, Wales).

What to do:Check if your products need UKCA certification (e.g., electronics, toys). Relabeling is a must.

🚫 Not Registering for UK VAT

All businesses importing into the UK must have a UK VAT number. Late registration leads to fines up to €40/day.

What to do:Register for VAT before shipping. Consider using a “duty deferment account” to postpone payments monthly.

5.2 High-Risk EU Countries: Special Requirements

Some EU countries have strict — and often overlooked — rules:

🇮🇹 Italy: RFID Tags for Textiles

All clothing, footwear, and home textiles imported into Italy must have a unique RFID tag for traceability.

Beginner tip:Work with a forwarder that offers RFID tagging at origin. Missing tags = full shipment rejection.

🇵🇱 Poland: Dual Certification for Electronics

Electronics entering Poland require both CE (EU standard) and RoHS (Restriction of Hazardous Substances) certifications.

Beginner tip:Ask your supplier for both test reports. Don’t assume CE covers everything.

🇧🇪 Belgium: Extra Health Permit for Foods

Food, supplements, or cosmetics require an additional sanitary import license from the FASFC (Belgium’s food agency).

Beginner tip:Always check if your products are “food adjacent” — even vitamins or herbal teas fall under this.

6. Real-World Case: Shipping 200kg from China Factory to Amazon FBA in Germany

(Total Cost: €415 | 35 Days | 23% Below Market Average)

Here’s exactly how we moved 200kg of electronics from Guangzhou to Amazon’s FRA1 warehouse – step by step:

Stage 1: Factory Pickup & Prep (1 Day | €50)

Key Actions:

✅ Pre-Shipment Inspection: Verified product quality at the factory (rejected 5 defective units)

✅ Compliance Labeling: Applied German FBA labels + safety warnings beforeleaving China

⚠️ Avoid: Skipping inspection – defective goods cost €150+/unit in disposal fees at EU ports

Stage 2: Ocean Freight to Hamburg (32 Days | €240)

Route: Guangzhou → Shenzhen Yantian Port → Hamburg Port

Cost Breakdown:

Sea freight (LCL): €200

Fuel surcharge: €15

Documentation: €25

Critical Move:

EORI Pre-Clearance: Submitted German EORI number before sailing

Pitfall Alert: Missing EORI = 5-10 day customs holds + €100/day storage fees

Stage 3: German Customs Clearance (2 Days | €85)

Process Flow:

Success Factors:

Included EPR Registration Number (German WEEE) in declaration

Attached product safety test reports

Used a pre-vetted customs broker (saved 3 days vs. DIY)

Stage 4: Final Delivery to FRA1 (1 Day | €40)

Logistics:

Hired local carrier via Amazon Partnered Shipments

Pre-scheduled delivery slot to avoid €75 late fee

Scanned all cartons into Seller Central upon arrival

Pro Tip:“Amazon’s FRA1 warehouse is extremely stricton pallet dimensions (120x80x180cm max). We shrink-wrapped to their exact specs to avoid €45 rework fees.”

How We Saved 23% vs. Competitors

|

Cost Factor

|

Standard Rate

|

Our Rate

|

Savings

|

|

Sea Freight

|

€290

|

€240

|

€50

|

|

Customs Clearance

|

€120

|

€85

|

€35

|

|

Trucking to FBA

|

€60

|

€40

|

€20

|

|

Total

|

€470

|

€415

|

€55

|

Savings Secrets:

Booked LCL consolidation during non-peak season

Used EPR-registered forwarder to skip €75 compliance fee

Chose Hamburg port over Rotterdam (lower German handling fees)

Key Takeaways for Beginners

Never skip pre-inspection – 90% of customs fails start with product defects

EPR is non-negotiable for Germany – register beforeshipping electronics

Pre-clear documents – saves 3-7 days in customs

Partnered carriers cut last-mile costs by 30%

“This route works best for 100-500kg shipments. For larger volumes (>800kg), switch to FCL containers via Rotterdam to save €120+”

– Logistics Manager, AMZ Freight Pro

Ready to replicate this? [Get Your Custom Quote] for the Guangzhou→FRA1 route.

Europe FBA Freight Forwarding FAQs (New Content Only

Q: Can I ship perfumes or aerosols to European FBA warehouses?

A: Most EU FBA centers ban aerosols/perfumes without special documentation. You’ll need:

SDS (Safety Data Sheet)UN38.3 test report for lithium batteries (if applicable)

Use sea freight only – air transport is prohibited.

Q: How do I handle FBA returns from Europe to China cost-effectively?

A: Don’t ship returns back – use these alternatives:

Local disposal services: €0.5-€2.50/item in Germany/France

Refurbishment hubs: Partner with EU-based 3PLs for returns processing

Q: What’s the cheapest way to ship samples to Europe pre-launch?

A: Use DDP Express Couriers like DHL eCommerce:

Under 5kg: €25-€35 (door-to-door in 7 days)

Key: Always declare as "Commercial Samples – No Value"

Q: Can one freight forwarder manage shipments to both Amazon UK and EU warehouses simultaneously?

A: Yes, but demand dual-channel clearance:

UK shipments: Use GB EORI + UKCA marking

EU shipments: Separate EU EORI + CE marking

Forwarders like Shapiro EU specialize in split shipments.

Q: How do I ship products with built-in batteries to Poland FBA?

A: Requires 3 critical documents:

Battery MSDS certificate

UN38.3 compliance statement

RoHS 3.0 (Poland-specific) test report

Air transport banned – only sea/rail allowed.

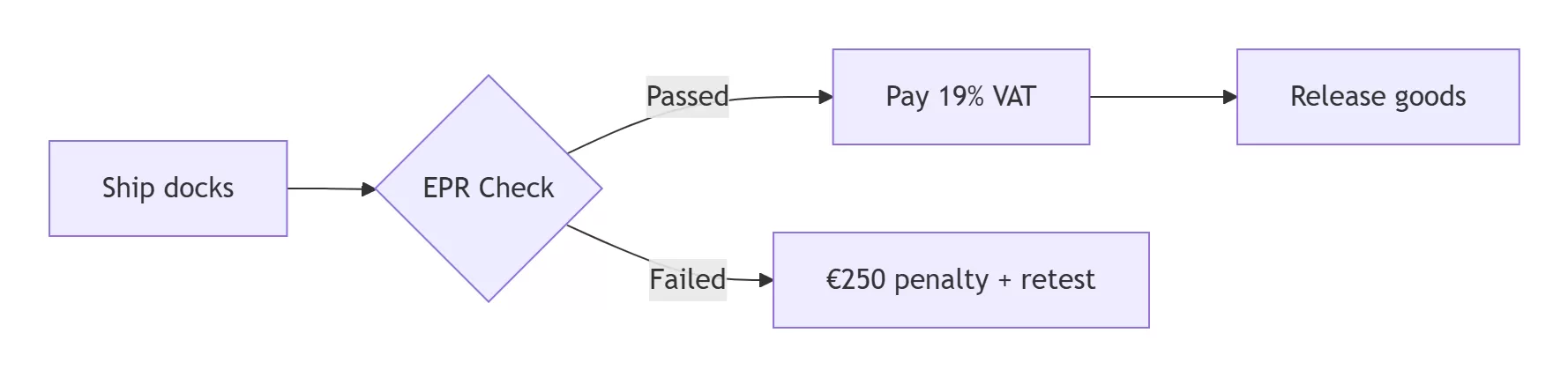

Q: What happens if my FBA shipment arrives without an EPR number?

A: Germany/France will:

Charge €250 penalty fee per shipment

Hold inventory 14-21 days for compliance review

Solution: Use forwarders with "Retroactive EPR Registration" services

Q: Are there weight restrictions for pallets sent to Amazon FRA4?

A: Yes – Frankfurt’s FRA4 enforces:

Max 500kg/pallet

Height ≤ 180cm

Overweight pallets incur €85 rework fees + 3-day delays.

Q: Can I use Amazon’s PAN-EU with my own freight forwarder?

A: Only if your forwarder:

Registers inventory in Amazon’s Centralized Inventory Portal

Handles VAT transfers between countries automatically

Most local forwarders can’t support this.

Q: What’s the fastest customs clearance port in Eastern Europe?

A: Budapest Airport (BUD), Hungary:

90% of shipments clear in <8 hours

Lower inspection rates than Poland/Italy

Ideal for electronics/medical devices

Q: How do I ship seasonal products to Europe without overpaying for storage?

A: Use Just-in-Time Warehousing:

Ship to forwarder’s EU warehouse (€0.10/day/pallet)

Release to FBA only when inventory is low

Forwarders like AMZ Freight Pro offer this.

EN

EN

FR

FR

ES

ES

JA

JA

PT

PT

RU

RU

AR

AR