Shipping from China to Amazon FBA involves a lot of confusing acronyms like FOB, DAP, and DDP. In the logistics world, these are technically called "Incoterms" (International Commercial Terms), but you can just think of them as "The Rules of Who Pays for What." While terms like FOB (Free on Board) and EXW (Ex Works) handle the origin side, the final delivery to the US or Europe usually comes down to two critical choices: DAP (Delivered at Place) vs DDP (Delivered Duty Paid).

For a traditional B2B importer with their own warehouse, this choice is just a matter of preference. But for Amazon FBA sellers, choosing the wrong Incoterm isn't just a paperwork error—it can result in your shipment being rejected by Amazon, stranded at customs, or hit with surprise tax bills that wipe out your profit margin.

In this comprehensive guide, we will break down the technical differences, analyze the hidden costs, and explain why 99% of successful FBA sellers choose DDP.

Part 1: The Technical Definitions (What Do They Really Mean?)

To understand the best choice, we first need to look at the official Incoterms 2020 rules regarding responsibilities.

What is DAP (Delivered at Place)?

Under DAP terms (formerly known as DDU - Delivered Duty Unpaid), the seller is responsible for shipping the goods to a named destination (e.g., Amazon’s warehouse in Dallas).

- Seller's Responsibility: Packaging, Export Customs, International Freight, Local Delivery.

- Buyer's Responsibility: Import Customs Clearance, Import Duties, and Taxes.

- The Catch: The carrier (FedEx/UPS/DHL) will not release the goods until the duties are paid by the receiver.

What is DDP (Delivered Duty Paid)?

DDP places the maximum obligation on the seller. The seller is responsible for delivering the goods to the named place in the country of importation, including all costs and risks.

- Seller's Responsibility: Everything. Shipping, Export, Import Customs Clearance, Payment of Duties, Payment of Taxes (VAT/GST), and Final Delivery.

- Buyer's Responsibility: Unloading the goods (in the case of FBA, Amazon does this).

- The Benefit: The goods arrive as a "landed cost" shipment. No extra bills, no customs phone calls.

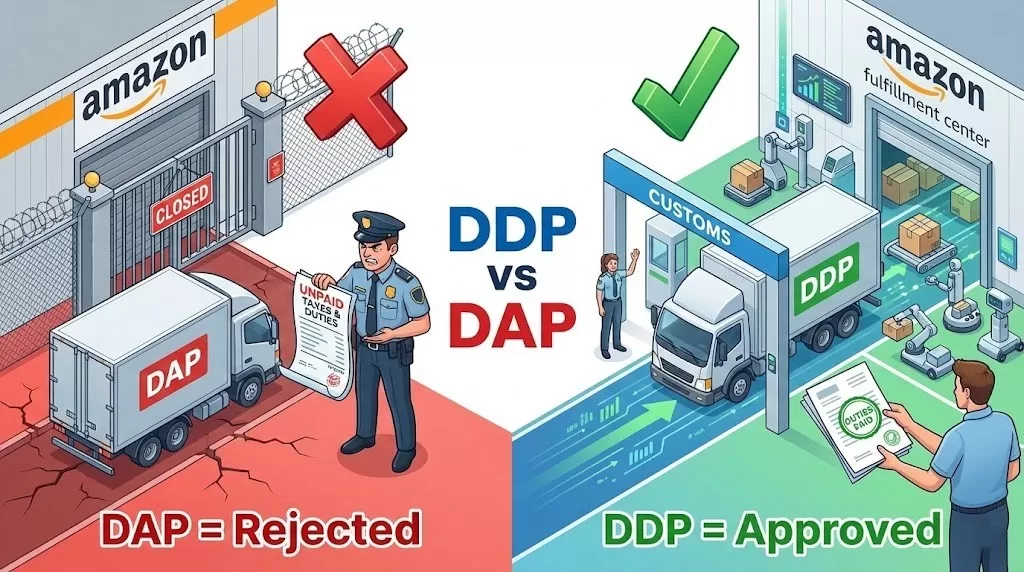

Part 2: The "Amazon FBA Trap" – Why DAP is Dangerous

This is the most critical section for Amazon sellers. You might see a cheaper shipping quote for DAP and think, "Great, I'll save money!"

Do not fall for this trap. Here is why:

1. Amazon is Not the "Importer of Record" (IOR)

Amazon’s Terms of Service are crystal clear: Amazon will not act as the Importer of Record for FBA shipments. They will not sign for customs documents, nor will they pay a cent in duties on your behalf.

2. The Rejection Scenario

If you ship via DAP:

1. The truck arrives at the Amazon Fulfillment Center (FTW1, ONT8, etc.).

2. The driver asks for payment of customs duties (e.g., $150).

3. Amazon warehouse staff refuses to pay.

4. The shipment is rejected.

3. The "Hidden" Costs of a DAP Mistake

Once rejected, your goods don't just sit there. They enter a logistics nightmare:

1. Return Shipping: Carriers will charge you double or triple to ship the goods back to the depot.

2. Storage Fees: You will pay daily storage fees while you try to find a customs broker to fix the mess.

3. Loss of Sales: Your listing goes out of stock while your goods are stuck in limbo.

Part 3: Why DDP is the "Gold Standard" for FBA

When you choose DDP Shipping (often referred to as "Double Clearance & Tax Included" by Chinese forwarders), you are effectively outsourcing the risk.

How DDP Works in Practice

When you hire a professional freight forwarder (like Forest Leopard) for DDP shipping:

1. We act as the Consignee: We use our own customs bond and tax ID to clear the goods.

2. We Prepay Duties: We calculate and pay the US Customs (CBP) or European tax authorities before the goods are even delivered.

3. Seamless Delivery: The truck arrives at Amazon with all fees paid. Amazon simply scans the barcode and receives your stock.

Result: You get a predictable, all-inclusive price per kilogram. No surprises.

Part 4: DDP vs DAP Comparison Table

|

Responsibility / Feature

|

DDP (Delivered Duty Paid)DDP

|

DAP (Delivered at Place) DAP

|

|

Export Declaration

|

Seller / Forwarder

|

Seller / Forwarder

|

|

International Freight

|

Seller / Forwarder

|

Seller / Forwarder

|

|

Import Customs Clearance

|

Seller / Forwarder (Key!)

|

Buyer (You must arrange this)

|

|

Import Duties & Taxes

|

Seller / Forwarder (Key!)

|

Buyer (Amazon won't pay this)

|

|

Risk of Amazon Rejection

|

✅ Near Zero ✅

|

❌ High ❌

|

|

Cost Structure

|

All-in-one Price (Higher upfront)

|

Lower Quote + Unknown Tax Bill

|

|

Best For...

|

Amazon FBA, Beginners, Dropshipping

|

Established Importers with private warehouses

|

Part 5: Real-World Scenario (Case Study)

Imagine you are shipping 500kg of phone cases from Shenzhen to Amazon US.

- Scenario A (DAP): Your forwarder quotes you $1.5/kg. You think it's a bargain. The goods arrive in LA, and customs demands $300 in duties. The carrier calls Amazon; Amazon hangs up. The carrier calls you in China at 3 AM. You scramble to find a US broker to pay the bill remotely. Total delay: 2 weeks. Extra fees: $500.

- Scenario B (DDP): Your forwarder quotes you $1.8/kg. It looks more expensive. However, this price includes shipping AND the $300 duty. The goods sail through customs, arrive at Amazon, and are live on your site in 16 days. Total extra stress: Zero.

The Lesson: DDP looks more expensive on paper, but it is cheaper in reality because it prevents disaster.

Part 6: How to Choose the Right Freight Forwarder

Not all "DDP" services are created equal. Some budget forwarders claim to offer DDP but use illegal clearance methods (like under-declaring value) that can get your account banned.

When selecting a partner for your supply chain, look for these qualifications:

- Transparency: Do they provide a clear breakdown of costs?

- Qualifications: Are they NVOCC & FMC certified? (This ensures they are legally authorized to issue bills of lading).

- Infrastructure: Do they have their own warehouses in the US/Europe to handle inspections if customs issues arise?

The Forest Leopard Advantage

At Forest Leopard, we don't just ship boxes; we protect your business.

- Compliance: We use legitimate customs bonds for all DDP shipments to the USA and Europe.

- Speed: Our Matson Clipper service offers 16-day delivery to the West Coast.

- Safety: If Amazon ever rejects a shipment for a non-customs reason (like a label error), we can reroute it to our Los Angeles or New York warehouses for relabeling.

Final Verdict

If you are an experienced importer shipping to your own private warehouse, DAP gives you more control over your tax filings.

But for Amazon FBA sellers, the verdict is clear: DDP is the only safe option. It turns a complex international trade transaction into a simple domestic delivery experience.

Ready to simplify your shipping?Check out our China Freight Forwarder Service for a transparent DDP quote, or learn more about How to Handle Amazon Returns if you have inventory issues.

EN

EN

FR

FR

ES

ES

JA

JA

PT

PT

RU

RU

AR

AR