A comprehensive, no-fluff playbook for exporters, buyers, e-commerce sellers and freight-forwarders — costs, transit times, door-to-door vs port-to-port, rail options, ports, customs, Amazon FBA, templates and tools.

Quick snapshot (read this first)

Typical transit times (typical ranges): Parcel/express 3–7 business days; Air freight 3–10 days (depending on consolidation/space); Rail freight (China → Europe rail corridors) ~15–25 days to Western Europe plus drayage; Ocean freight (major ports → France) 30–45 days for all-water routes (can vary).

Typical cost drivers: container vs LCL, weight vs volume, fuel & peak surcharges, origin & destination handling, customs duties & VAT.

Best short rule: use express for small urgent parcels; air for urgent palletized shipments; rail for mid-sized value/urgency tradeoffs; ocean (FCL/LCL) for cost-sensitive bulk shipments.

Are you ready?

Get real-time quotes for France

Get Quotes

Table of contents

Decision matrix — which mode to pick (at a glance)

Costs & transit times — detailed table and landed-cost example

Door-to-Door vs Port-to-Port — responsibilities, hidden costs, when to choose which

Rail freight (China → France) — routes, pros/cons, operational notes

Step-by-step: from booking to delivery (how-to checklist)

China ports — quick profiles & selection tips

France ports — which port for which destination and why

Choosing a freight forwarder (how to pick the right one for Amazon FBA) (China → France) — due diligence & templates

Amazon FBA & small e-commerce sellers — practical workflow & common mistakes

Risk management, insurance & claims (by mode)

Case studies (short, real-world slices)

FAQ (short, actionable answers)

1) Decision matrix — which mode to pick (fast)

| Mode |

Best for |

Typical transit (example) |

Cost profile |

Pros |

Cons |

| Express (DHL/UPS/FedEx) |

Small parcels, urgent D2C |

3–7 business days |

High per-kg |

Fast, simple door-to-door, includes tracking |

Costly for heavy/voluminous items; strict size limits. |

| Air freight |

Urgent pallets, medium value |

3–10 days (door) |

High (per kg) |

Fast, wide network |

More expensive than sea/rail; rate volatility. |

| Rail freight |

Mid-value, time-sensitive bulk |

15–25 days to Western Europe + drayage |

Mid (volume-friendly) |

Faster than sea, cheaper than air for many pallets |

Limited direct endpoints; requires intermodal drayage. |

| Ocean — FCL |

Large volume / containerized |

30–45 days typical |

Lowest per-unit (bulk) |

Best $/unit for volume |

Long transit, port & inland handling. |

| Ocean — LCL |

Smaller shipments but palletized |

35–50 days (consolidation adds time) |

Mid (pay per m³) |

No need to fill a container |

More handling, higher risk of delay/damage. |

| Sea-express / Sea+Truck (sea + road) |

Faster all-water+truck hybrids |

20–35 days |

Mid |

Lost-cost compromise |

Network & schedules vary by carrier. |

How to read this: match your product value, urgency and size to the mode — priority is: safety (high-value) → speed (urgent) → cost (bulk).

freight forwarding

Get real-time quotes for France

Get Quotes

2) Costs & transit times — realistic numbers and a landed-cost worked example

China → France — Ocean (sea freight)

| Container type |

Indicative cost (2025, USD) |

Typical transit time (door-to-door / port-to-port notes) |

| 20' GP (FCL) |

$1,200 – $4,500 |

~30–66 days (all-water 30–45d common; some routings/loops show 50–66d including transshipment/port delays). |

| 40' HC (FCL) |

$2,200 – $6,000+ |

~30–66 days (same caveats: carrier loop, transshipment and port congestion affect transit). |

| 40' GP / 45' HC |

$2,500 – $7,200 |

~30–66 days (used for higher volume; price/availability vary). |

| LCL (consolidated, per m³) |

€60 – €160 / m³ (varies widely by origin port & season) |

~35–75 days (consolidation + deconsolidation add time). |

Notes & interpretation

Ocean market is volatile in 2025: routes and carriers differ — use the above as ballpark ranges. Freightos and Flexport live-route tooling show many China→France quotes inside these bands.

“Transit time” above includes typical sailing + port handling; door-to-door will add origin haulage and destination drayage time.

Major cost drivers: origin port, carrier loop (direct vs transshipment), seasonality/peak surcharges, equipment availability and fuel surcharges.

China → France — Air freight

| Weight break / type |

Indicative cost (2025, USD / EUR per kg) |

Typical transit time (door-to-door) |

Best for |

| Consolidated air (AWB, economy) |

$3.0 – $6.0 / kg (CN → EU index around $3–$4/kg common in 2025) |

3–10 days |

Palletized urgent goods where air cost justified. |

| Express (air courier, premium service) |

$6 – $15+ / kg (small shipments, door-to-door) |

1–5 days |

Small urgent parcels and time-critical samples. |

Notes

Air rates vary by airport pair, weight break, and market congestion. Freightos CN→EU indexes in 2025 show commonly ~$3–$4/kg for consolidated air; premium express will be considerably higher.

freight forwarding

Get real-time quotes for France

Get Quotes

China → France — Express parcel (typical D2D courier)

(table uses EUR because many e-commerce sellers price in EUR for France)

| Parcel weight |

Estimated price (EUR, 2025) |

Transit time (days) |

DDP impact on parcel cost (what to expect) |

| 1 kg |

€20 – €60 |

3–7 business days |

Adds VAT + possible customs clearance fee: DDP usually increases upfront cost by VAT (20%) + clearance fee (€8–€25); for low-value parcels VAT may be collected by carrier (adds €~5–€20 depending on parcel value & carrier). |

| 6 kg |

€45 – €150 |

3–7 business days |

DDP effect scales with parcel declared value; expect VAT + duty (if any) + clearance fee, so DDP can add ~€20–€80 depending on value and duty rate. |

Notes

Express couriers charge by higher of actual weight or volumetric weight (volumetric = L×W×H (cm) / 6000). For bulky but light parcels, volumetric billing increases the price.

Exact courier list-price varies by negotiated accounts; many e-commerce exporters use courier partners with discounted slabs.

China → France — Rail freight (China → Europe)

| Transport variant |

Indicative cost (EUR / per 40' eq. or per pallet) |

Transit time (days) |

| Block train / container via China→Europe rail corridors (to Western EU hub) |

€4,000 – €7,000 per 40' equivalent (market & corridor dependent) |

~15–25 days to Western Europe terminals; +2–7 days drayage to French delivery points. |

| Palletized consolidated rail (per pallet) |

€200 – €500 / pallet (depending on pallet volume/weight & corridor) |

~18–30 days (including last-mile) |

Notes

Rail costs can be higher than seasonal ocean prices but lower than air for mid-urgency pallets. Performance depends on corridor (northern vs central routes), border throughput and intermodal handling.

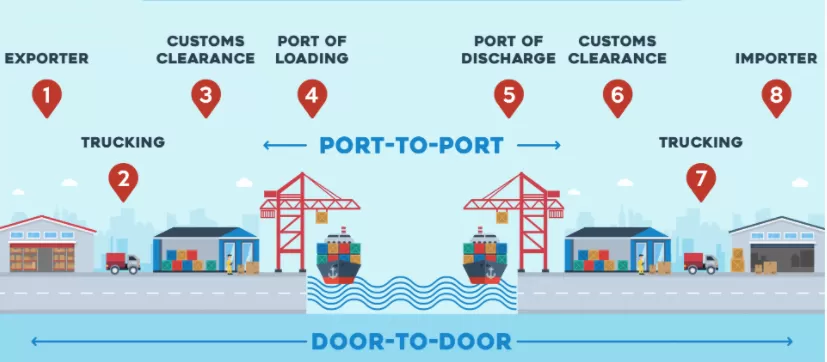

3) Door-to-Door vs Port-to-Port — what you’re really buying

door-to-door(Amazon FBA door-to-door shipping costs explained) (D2D)

What it covers: pickup at seller, export customs, international carriage, import customs clearance, local delivery to buyer’s door or warehouse.

Who should use it: first-time importers, e-commerce sellers, small shippers who want simplicity.

Hidden costs to watch: last-mile surcharges, import clearance fees, remote area delivery fees, customs document corrections.

Pros: single contract, single point of contact, minimal coordination.

Cons: usually higher than port-to-port; reduced flexibility if receiver wants to pick up at port.

Port-to-Port (P2P)

What it covers: carrier moves cargo between named vessel ports; shipper/consignee handle origin/destination drayage and customs.

Who should use it: experienced importers with local logistics partners, buyers with cheaper inland transport or those collecting at port.

Hidden costs to watch: port storage if cargo is not collected quickly; demurrage; inland trucking arranging and costs; clearance delays if documentation incomplete.

Decision guide (quick)

Choose D2D if you want low operational load and predictable process for small/medium shipments.

Choose P2P if you can coordinate inland transport, want lower headline freight costs, and can manage port operations.

Pro tip: always ask freight forwarders for a total landed cost quote under the Incoterm you prefer (FOB/CIF/DDP) and compare. Detailed operational advice and DDP services are commonly marketed by e-commerce oriented providers.

4) Rail freight (China → France) — when and how it fits

Rail freight has matured into a viable mid-path between sea and air for many shippers especially since the mid-2010s. Its sweet spot: time-sensitive pallets that don’t justify air costs or where sea lead times are unacceptably long.

Key operational points

Routes: China → Central Asia → Russia/Belarus → Poland/Germany/Belgium, then onward to France by rail/truck interchange; some services terminate in Belgium/Germany for final drayage to France.

Transit: 15–25 days to Western Europe terminals; add 2–7 days for customs/drayage depending on border conditions and final destination.

Load types: pallets, FCL equivalent (block trains), and some containerized services. Not ideal for odd dimensions or perishable goods requiring specific cold-chain unless specialized wagons are used.

Customs & paperwork: rail crosses multiple customs zones; single-window transit documents help but expect more handoffs and document checks than ocean. Use a forwarder experienced in rail corridors.

Advantages: predictable schedules vs some ocean loops, typically lower carbon footprint than air, faster than sea for many routes.

Drawbacks: limited direct access to all French inland points — often involves intermodal transfers and additional truck legs; capacity and customs bottlenecks can cause variability.

When to pick rail: you want ≈2–3 week transit vs 4–6 weeks ocean, and air is too expensive. Also attractive for higher-value goods where speed matters but cost is still a constraint.

5) Step-by-step: from booking to delivery (actionable checklist)

This is the operational checklist you should follow or require from your forwarder. Use the HowTo sections as your day-by-day SOP.

Before booking (seller/exporter)

HS code & tariff classification — confirm HS code; wrong classification = wrong duty.

Product restrictions — check whether items need CE, sanitary, phytosanitary, battery declarations, or licences for France/EU.

Packaging & labeling — pack to withstand double handling for LCL; label with SKU, carton no./total, origin. For FBA, follow Amazon labeling strictly.

Incoterm — agree on FOB/CIF/DDP and ensure both parties understand who pays what.

Insurance — consider all-risk cargo insurance for high-value shipments.

Booking & documentation

Book space with chosen mode and confirm ETD/ETA.

Prepare docs: commercial invoice, packing list, bill of lading/air waybill, certificate of origin (if required), insurance certificate, FBA paperwork (if applicable). SINO Shipping

Provide full consignee data including EORI/VAT where necessary.

Origin handling

Pickup & consolidation (for LCL) or container stuffing (for FCL).

Export customs clearance (breakdown of the inspection process) — forwarder files export declaration; ensure HS and invoice values match.

Line-haul & monitoring

Track milestones: departure, arrival at transshipment, arrival at destination port/terminal. Request proactive updates if shipment is time-sensitive.

Destination & final mile

Import customs clearance — submit docs, pay duties & VAT; for DDP the forwarder handles this.

Inland delivery or FBA delivery — confirm appointment windows for truck delivery to avoid detention.

Proof of delivery and reconciliation — check for damage and file claims immediately if needed.

Downloadable checklist: include this SOP as your one-page PDF for operators and buyers (lead magnet).

6) China ports — quick profiles to help you choose origin

Use these port facts to judge equipment availability, frequency of sailings to Europe, and inland connectivity.

Shanghai (Shanghai Port / Yangshan) — China’s busiest container port: highest frequency of headhaul sailings to Europe; good for east/central China suppliers. Fastest connection options but often higher terminal charges.

Ningbo — close to manufacturing clusters; competitive rates and growing sailings to Europe. Good alternative to Shanghai for cost control.

Shenzhen (Yantian / Shekou) — serves southern manufacturers (Guangdong/Foshan). High sailing frequency to Europe, often used for electronics & garments.

Qingdao — strong in North China exporters; good vessel options to northern Europe and west bound loops.

Xiamen / Fuzhou / Tianjin — useful depending on supplier proximity and specific carrier rotations.

Port selection tips

Pick the port nearest your factory unless price differentials justify longer domestic haulage.

For urgent schedules, prefer origin ports with higher sailing frequency to minimize waiting for the next vessel.

7) France ports — pick the right arrival point

Key French ports and their strengths:

Le Havre — France’s main container gateway for deep-sea services; close to Paris with robust truck & rail links. Good for northern/central France deliveries.

Marseille Fos — southern gateway, better for Mediterranean and southern France inland distribution. Efficient for LCL rollings to southern Europe.

Dunkirk — northern French port, growing container handling, useful for northern France/Benelux transits.

Antwerp/Rotterdam (via transshipment) — not French ports but often used as transshipment hubs with final delivery to France by truck or feeder; sometimes cheaper or faster depending on sailing loops.

How to choose: base the decision on where most of your customers are (Paris vs Lyon vs Marseille), total landed cost to final zip code (not just port freight), customs clearance capacity and road/rail availability for last-mile.

8) Choosing a freight forwarder (China → France) — due diligence & templates

What to check (quick audit)

Business license and local office footprint (origins in China & European partners).

Clearance capability (customs broker in France), FBA handling experience, and references from similar shippers.

Sample quote transparency: itemized freight, origin fees, destination fees, surcharges, insurance options.

Liability & insurance terms; claims turnaround and track record.

Practical buyer checklist (phone/email)

Ask for example shipping timelines from your origin city to your destination city.

Request one comparable reference: a client who ships similar goods and can vouch for on-time performance.

Confirm FBA experience if shipping to Amazon — ask about label & carton content handling.

Amazon FBA & small e-commerce sellers — practical workflow & common pitfalls

Key operational points for FBA inbound to France

Labeling & carton content: Amazon requires unit labels and accurate carton content lists. Non-compliance leads to refused intake and fees. Use a forwarder experienced in Amazon inbound deliveries.

Preferred shipping modes: for small, frequent shipments, express or small air cargo; for higher quantity, LCL with careful consolidation and sealed pallets is cost-effective.

Document tip: include Amazon shipment ID clearly on paperwork; ensure the delivery appointment is arranged in advance to avoid detention.

VAT & EORI: sellers may need VAT registration or use of a fiscal representative depending on their selling model in France. This affects customs clearance and payment of VAT.

Amazon FBA

Get real-time quotes for France

Get Quotes

Common mistakes

Using a forwarder that does not prep for Amazon requirements → returns / penalties.

Declaring wrong SKU counts on the packing list → Amazon rejects.

Choosing port-to-port without an experienced local partner to manage final mile to Amazon.

10) Risk management, insurance & claims — what to prepare (by mode)

Ocean: risk of prolonged port congestion and container damage; insure for all-risk and keep B/L copies. Preserve photos and damage reports.

Rail: multi-border transit increases likelihood of documental audits; maintain chain-of-custody documents.

Air/Express: generally lower physical damage risk but documentation discrepancies still cause delays.

Claims: file quickly — insurers and carriers have strict time windows; maintain invoice, packing list, B/L/AWB, photos and independent survey where necessary.

11) Case studies (short, instructive)

Mid-sized FBA seller saved 18% switching 2 monthly shipments from express to LCL with dedicated pallet consolidation — invested in stricter packing and labeling to avoid FBA refusal. (Hypothetical but typical.)

Manufacturer reduced variability by switching origin port from Shenzhen to Ningbo after comparing weekly sailings and local trucking costs — shorter inland distance saved waiting time that otherwise added 5–7 days.

Retailer used rail for seasonal goods and cut transit from 45 to 20 days with acceptable cost increase vs ocean — required an efficient European drayage partner for last-mile.

12) FAQ — concise, actionable answers

How long does shipping from China to France take?

Parcel/express: 3–7 business days. Air freight: 3–10 days. Rail: ~15–25 days to European hubs + drayage. Ocean: ~30–45 days typical.

What are the main cost drivers?

Container choice (FCL vs LCL), weight vs volumetric, fuel & peak surcharges, origin/destination handling, customs duty & VAT.

Which mode is best for Amazon FBA?

Depends on shipment size: express/air for very small urgent lots; LCL/FCL with dedicated FBA prep for larger shipments. Use a forwarder with FBA experience.

Do I need special certificates to import to France?

Depends on product: CE for electronics, phytosanitary for plants, battery certificates for lithium batteries. Check specific product regulations.

What are DDP and DDU (understand the key differences between DAP and DDP)?

DDP (Delivered Duty Paid): seller handles duties/VAT and delivery. DDU: buyer handles import duties and local clearance. DDP is simpler for buyers but costlier for sellers.

Is rail a reliable alternative?

Yes for many product types — offers a middle path between sea and air but requires good intermodal partners for final delivery.

How is volumetric (dimensional) weight calculated for air and express shipments?

Volumetric weight = (Length × Width × Height) in cm ÷ 6000 (air/express common divisor). Carriers charge by the greater of actual or volumetric weight — for bulky but light goods always quote both and use the higher number.

What common surcharges should I expect beyond the headline freight rate?

Expect items such as BAF/CAF (fuel), peak season surcharges (PSS), terminal handling charges (THC), security/ISPS fees, documentation fees, and local delivery or remote-area surcharges. Always ask forwarders for an itemized quote showing each surcharge.

How can I avoid demurrage and detention charges at French ports?

Book truck appointments immediately on vessel ETA, ensure customs docs are pre-lodged, pay any duties promptly (or use DDP), and arrange pickup/collection windows — delays beyond free time trigger demurrage (port) and detention (container) fees.

When is FCL preferred over LCL (and vice-versa)?

Choose FCL when your cargo volume approaches a full container (better per-unit cost, lower handling risk). Choose LCL when volume is small and speed/working capital matter — but expect more handling, longer consolidation time and slightly higher per-m³ cost.

What practical steps speed up customs clearance in France?

File import declarations early (pre-lodgement), provide accurate HS codes and commercial invoices, use an experienced French customs broker, have EORI/VAT numbers ready, and supply any required certificates in advance (CE, sanitary, etc.) to avoid manual checks.

What are my options for handling returns (reverse logistics) from France to China?

Options: consolidating returns into periodic LCL shipments, using express for high-value returns, or engaging a returns management provider that handles local collection, inspection and bulk export. Clarify RMA, inspection standards, and who covers return duties/transport in your returns policy.

Exploring Other Major Logistics Routes?

While this guide focuses on France, we also provide detailed guides for other major destinations:

United States: Comprehensive US shipping guide with FBA specifics

European Markets: Best freight forwarders for European FBA

Key US Hubs: New York, Los Angeles, Chicago

UK Specific: Shipping to Birmingham for affordable FBA options

Logistics Models: Understand 1PL, 2PL, 3PL, 4PL differences

Compare All Options

Each destination offers unique advantages depending on your cargo type and final distribution needs. Use our detailed guides for Baltimore, Miami, and other major logistics hubs to develop an optimal strategy.

EN

EN

FR

FR

ES

ES

JA

JA

PT

PT

RU

RU

AR

AR