If you import into Manchester from China, this guide is the playbook you actually need — not a shallow overview. Below you’ll find route-by-route timelines, the exact documents and actions for each leg, cost structure and landed-cost logic, Manchester operational details you rarely see in generic “China→UK” pages, and practical recommendations for Amazon FBA sellers and small importers. I wrote this as an experienced freight-forwarder editor: concise, actionable, and ready to drop into a commercial page.

Quick highlights (TL;DR)

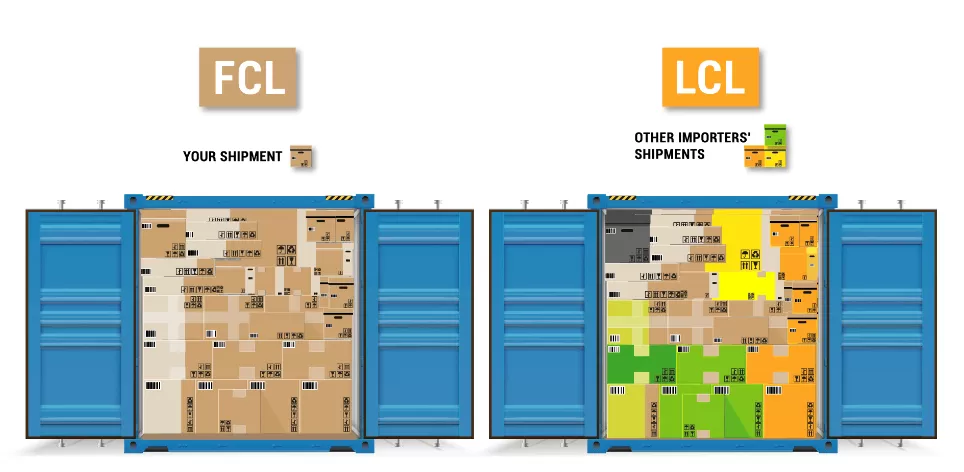

Best cost per unit: Sea freight (FCL) — best for replenishment and large shipments.

Best speed: Air freight / express — use for urgent FBA restock or high-value samples.

Best balance (time vs cost): Sea + truck (sea-car / “sea-truck”) or sea→express hybrid (“sea-express”).

Manchester specifics: most China ocean services discharge at UK gateways (Felixstowe, London Gateway, Southampton) then move inland to Manchester by truck or rail — plan 1–3 extra days for inland movement and local handling.

How to read this page

I list each transport option, the step-by-step route, realistic timing per step, and exact documents you must have for that step.

You’ll get one sample landed-cost structure and three buyer personas with sample choices.

There’s a dedicated Amazon FBA section with the non-negotiable labelling/packing requirements.

1) China to Manchester route comparison (summary table)

Are you ready?

Get real-time quotes for Manchester

Get Quotes

Top-level quick-glance table (for hero / highlights)

| Mode (summary) |

Typical door-to-door time (China → Manchester) |

Cost indicator (image ranges) |

Best for |

| Ocean (FCL / LCL) |

47–66 days |

FCL: $3,669–$6,999 (by container) / LCL: $512–$3,208 (by CBM) |

Large replenishment (FCL) or small non-urgent batches (LCL) |

| Air (air cargo) |

6–10 days |

$925–$3,411 (by weight tiers) |

Urgent light/high-value shipments |

| Express (courier) |

3–6 days |

$315–$1,916 (small parcels → small pallets) |

Very small urgent parcels / FBA samples |

| Hybrid (sea+truck / sea→express / sea+rail) |

47–66 days (sea leg) + 1–3 days handoff |

Depends on mix — typically cheaper than full air |

Cost/time trade-off: shrink last mile or avoid port rework |

Place this table as the “quick answer” card at the top of your page.

China to Manchester - Ocean Freight/FCL

| Load |

Unified transit time (door-to-door) |

Price (image) |

When to choose |

Key docs |

| 20' container |

47–66 days |

$3,669–$4,891 |

Regular replenishment, pallets or full-load stock |

Commercial invoice, Packing list, B/L, Export declaration, EORI |

| 40' container / 40'HC |

47–66 days |

$4,722–$6,296 |

Larger volume; better unit cost |

Same as 20' |

| 45'HC |

47–66 days |

$5,249–$6,999 |

Oversize or high-cube requirements |

Same as 20' |

China to Manchester — Ocean / LCL

| Load (CBM) |

Unified transit time (door-to-door) |

Price (image) |

When to choose |

Key docs |

| 1 CBM |

47–66 days |

$512–$683 |

Very small consignments where waiting is acceptable |

Commercial invoice, Packing list, Consolidation manifest, House B/L |

| 5 CBM |

47–66 days |

$1,417–$1,889 |

Small-batch resupply; compare vs FCL threshold |

Same as 1 CBM |

| 10 CBM |

47–66 days |

$2,406–$3,208 |

Approach FCL economics — check FCL pricing |

Same as above |

| Load (kg) |

Unified transit time (door-to-door) |

Price (image) |

When to choose |

Key docs |

| 100 kg |

6–10 days |

$925–$1,234 |

Urgent light high-value shipments / sample packs |

AWB, Commercial invoice, Packing list, Export declaration, EORI |

| 300 kg |

6–10 days |

$1,789–$2,386 |

Mid-size urgent shipments |

Same as 100 kg |

| 500 kg |

6–10 days |

$2,558–$3,411 |

Large urgent shipments — evaluate cost vs sea + express |

Same as 100 kg |

China to Manchester — Express (courier)

| Load (kg) |

Unified transit time (door-to-door) |

Price (image) |

When to choose |

Key docs |

| 10 kg |

3–6 days |

$315–$420 |

Samples, urgent returns, single SKU FBA sample boxes |

Courier waybill, Commercial invoice (courier handles most export/import processes) |

| 100 kg |

3–6 days |

$1,437–$1,916 |

Small pallets / urgent small-batch FBA |

Same as 10 kg; pallet labelling may apply |

2) Ocean (FCL & LCL): exact step-by-step with times and documents

When to use: large replenishment (FCL) or small but non-urgent shipments (LCL).

Step A — Pickup & Chinese export customs

Time: 1–3 days typical if the supplier has paperwork ready.

Docs: Commercial Invoice, Packing List, Contract/Proforma if requested, and Export Customs Declaration (handled by your exporter or forwarder).

Tip: instruct the supplier to confirm the HS code and gross/net weights—mismatches cause delays and rework.

Step B—Port stuffing/consolidation

Time: 1–3 days at origin port (depends on consolidation cycles).

Docs: For FCL you’ll get a House B/L or Carrier B/L after stuffing. LCL needs a consolidation manifest.

Tip: LCL adds deconsolidation risk and extra handling fees; for >8–10 CBM, assess FCL pricing.

Step C—Ocean transit

Time: typical ocean transit China → UK gateway 20–35 days depending on origin port and route (weekly sailings; transshipment adds time).

Step D—Destination port arrival & customs release (UK)

Time: 0.5–4 days if docs are correct; inspections or duty disputes add days.

Docs: Bill of Lading (original if required), commercial invoice, packing list, importer EORI, any licenses/permits needed (e.g., toys, electronics).

Step E—Inland movement to Manchester (truck or rail)

Time: 1–3 days commonly from Felixstowe/London Gateway to Manchester (truck/rail options).

3) Air freight & Express: step-by-step

When to use: urgent restock, small high-value goods, or time-sensitive FBA needs.

Air freight (carrier)

Pickup & export: 0.5–1 day.

Airport handling & AWB issuance: same day–1 day.

Flight/transit: 1–2 days (direct) or 2–4 days (with connections).

UK customs clearance & delivery to Manchester: 0.5–2 days.

Docs: AWB, commercial invoice, packing list, export declaration, and EORI for import.

Express couriers (DHL/UPS/FedEx)

Typical total: 1–5 days door-to-door (global express networks).

Docs: Often handled by courier; you still need a commercial invoice and correct commodity descriptions. Express is easiest for small sellers.

4) Sea-car (sea + truck)—how it actually works

What it is: full container moves by ship to a UK gateway, then direct trucking to Manchester (or rail to an inland terminal). This reduces handling and often the overall landed cost for FCL flows.

Core benefit: one stuffing in China, one unstuffing in the UK final destination—fewer touches than port consolidation.

Typical total time: ocean transit + 1–3 days trucking—often comparable to FCL door-to-door but with less inland chaining.

Docs for handover: standard B/L + inland haulage instructions; your forwarder arranges customs release at port or in-bond transfer to rail/truck.

5) Sea→Express hybrid (“hai-”pai”)—when to use it

Use case: you have a limited budget for full air freight, but you need to shorten the last mile. Typical approach: ship by sea to a major hub, deconsolidate, and move parcels or palletized cargo by express networks into Manchester.

Timing: sea leg as usual, plus 1–3 days for express last mile; you can shave several days compared to pure ocean LCL.

Docs: B/L for sea leg; express airway bills and commercial invoices for the express handoff.

6) Port-to-Port vs Door-to-Door—What to choose

Port-to-Port: you receive at a UK port and manage customs/collection. Use if you have a UK warehouse, local clearances, or a bonded facility. Lower service cost, more control.

Door-to-Door: the forwarder handles everything from factory pickup to the Manchester warehouse. Higher fee but minimal complexity for you—ideal for first-time importers.

7) Amazon FBA — practical checklist for small/medium sellers

If you ship to Amazon UK or use a prep center, non-compliance will cost time and money. Follow these rules:

Create a shipping plan in Seller Central and produce unique FBA Box ID labels for each carton; pallets require four pallet labels (one on each side). Stick to Amazon’s measurements and pallet rules.

Packing & prep: polybags, bubble wrap, suffocation warnings, and barcode placement must meet Amazon rules — otherwise inbound is refused or reworked.

Customs & EORI: Amazon does not clear customs for you — ensure your importer (you or agent) has EORI and completes import declarations.

Best transport choices by scenario: express for urgent restock; LCL/FCL door-to-door for cost-sensitive replenishment; consider a 3PL / prep center in UK for labelling to avoid returns and fines.

8) Documents checklist

Exporter side (China): Commercial Invoice, Packing List, Export Customs Declaration, Contract, Certificate of Origin (if claiming preferences).

Transport docs: Bill of Lading (B/L) or Sea Waybill, Air Waybill (AWB), House B/L if using NVOCC, courier waybill.

Importer (UK): EORI number, Import Declaration (customs), proof of VAT payment or deferment, licences/certificates where required (e.g., CE/UKCA stats for electronics/children’s products).

9) China to Manchester —Landed-cost framework

Landed cost = Product cost + International freight + Insurance + Import duty + Import VAT + Local handling & delivery + Unexpected contingency (demurrage/storage).

10) Manchester operational notes — what local importers must know (differentiator)

Common entry ports for China cargo: Felixstowe, London Gateway, Southampton — then inland by road or rail to Manchester’s freight hubs.

Rail option: intermodal services run from a few UK ports to inland terminals near Manchester (can save cost/time on congested roads).

Empty container returns & depot windows: landlords enforce cut-off windows; missed return slots = detention/demurrage — plan pick-up/delivery windows with your inland carrier.

Local carriers / terminals: keep a vetted list of two truckers and a rail operator — redundancy avoids last-mile failure. (Add local partner logos/contacts on your page.)

Freight forwarding is the backbone of a smooth import: the forwarder picks the best route, books space, handles export/import customs, arranges inland delivery to Manchester, and fixes problems so you don’t have to.

Core tasks: route planning (origin port → UK gateway → truck/rail), space booking (FCL/LCL/air), export & UK import clearance, inland drayage/rail to Manchester, insurance & claims.

Quick timing guide: Ocean (FCL/LCL) ~47–66 days; Air ~6–10 days; Express ~3–6 days (assumes correct docs).

Docs you need: Commercial invoice, packing list, B/L or AWB, exporter’s customs docs, importer EORI, plus any product certificates.

Ask your forwarder for a sample landed-cost for your SKU (freight + THC + duty + VAT + inland) — it’s the fastest way to see true cost.

freight forwarding

Get real-time quotes for Manchester

Get Quotes

Key Tips: Reduce Shipping Costs & Time (China to Manchester)

Consolidate Smartly: Combine smaller shipments into a Full Container Load (FCL) once you hit ~10 CBM to drastically cut costs versus LCL.

Optimize Routes: For a balance of cost and speed, ship bulk by sea and use express services for urgent items from the UK port.

Plan Ahead & Pack Tight: Book Q3/Q4 shipments early to avoid peak surcharges. Right-size your packaging to reduce dimensional weight fees.

Simplify Customs: Pre-submit accurate documentation and harmonized HS codes with your supplier to prevent clearance delays.

Work with the Right Partners: Consider using a UK prep center for Amazon FBA to avoid issues. Bundle services with a forwarder who handles both China export and UK import for smoother operations.

Quick Action:Calculate your FCL break-even volume and audit your packing to eliminate wasted space.

FAQs

How do currency swings affect my freight invoices?

Freight contracts and surcharges are usually billed in USD or the carrier’s currency. Strong currency moves can change your landed cost between quotation and invoicing; to reduce volatility, either fix rates with the forwarder (short-term contract) or add a currency cushion to your pricing.

What triggers demurrage and how quickly does it start?

Demurrage clocks begin once free time at the terminal expires (counted in calendar days). Free time varies by carrier and port — missing pickup windows or delayed customs release are common triggers. Always confirm the free time with your forwarder and plan container returns in advance.

If goods are inspected by UK authorities, who pays for additional costs?

The party responsible depends on your Incoterm. Under DDP or if the forwarder arranged clearance, the forwarder/seller usually pays initial fees but will invoice you. Under DAP/FOB, the importer typically handles inspection costs. Agree this before shipping.

Can I insure only against total loss rather than all-risk to save money?

Yes — Total Loss policies are cheaper but don’t cover partial damage or theft. For high-value, damage-prone goods, All-Risk insurance is almost always recommended. Read exclusions carefully and value shipments correctly for claims.

What’s the quickest way to prove a customs valuation dispute was honest?

Keep clear, dated purchase records: supplier invoices, bank payment receipts, contract terms (incoterm), and freight/insurance invoices. These form the core evidence for HMRC valuation checks.

Can a forwarder guarantee a fixed transit time?

No reputable carrier can guarantee ocean transit times — only estimated windows. Airlines provide firmer schedules, but delays happen. Use service-level agreements (SLAs) for performance expectations and penalties where appropriate.

Are there quick wins to reduce small-parcel costs to FBA in the UK?

Yes — consolidate smaller packages into pallet shipments to a UK prep center, then distribute to FBA sites; or use consolidated LCL+UK palletization to cut courier fees. The prep center prevents non-compliance fines.

How should I price for unexpected storage costs at destination?

Add a contingency line to your landed cost (e.g., 2–5% for small volumes, higher seasonally) and stipulate who bears storage after free time in your agreement with the forwarder.

Is it worth signing a long-term contract with a carrier?

If you move regular volume, yes — contracts can lock rates and capacity. However, include force-majeure and review clauses to avoid paying above-market fees in rapid rate declines.

How do I choose between rail and road once cargo lands at a UK gateway?

Choose rail for predictable schedules and heavier palletized flows; choose road for door-to-door flexibility and short lead times. Factor in terminal drayage and last-mile costs.

What’s the single best thing to avoid customs delays in the UK?

Submit accurate, full documentation (correct HS codes, EORI, declared values) before arrival — advance filings reduce risk of inspections and speed clearance.

If I want to scale imports to Manchester, what operational KPI should I track first?

Track inbound lead time variance (actual vs planned days). Reducing variance improves forecasting, lowers stock buffers, and reveals bottlenecks to solve.

EN

EN

FR

FR

ES

ES

JA

JA

PT

PT

RU

RU

AR

AR